Ethereum (ETH) price has been facing a challenging macro environment for the past six months, marked by a persistent downtrend. Since March, ETH has struggled to maintain a bullish momentum, repeatedly testing its long-term downtrend line as support.

However, recent sentiment shifts suggest that recovery might be on the horizon. The question remains whether this recovery will be more difficult than anticipated as Ethereum’s price action continues to remain rangebound.

Ethereum Is Not Facing Bearishness

The MVRV Long/Short Difference indicator shows an essential insight into Ethereum’s current market conditions. For the first time since November 2023, this metric has fallen into the negative zone, marking a ten-month low.

This signals that both long-term and short-term holders are experiencing equal gains and losses, which is typically an indicator of market indecisiveness. The decline in the MVRV difference is a sign of short-term weakness rather than a strong indication that Ethereum has reached a market bottom.

Short-term holders usually hold more speculative positions, while long-term holders are considered stronger hands. Ethereum’s short-term price action might face continued pressure with both types of holders at a relative equilibrium.

Read more: How to Invest in Ethereum ETFs?

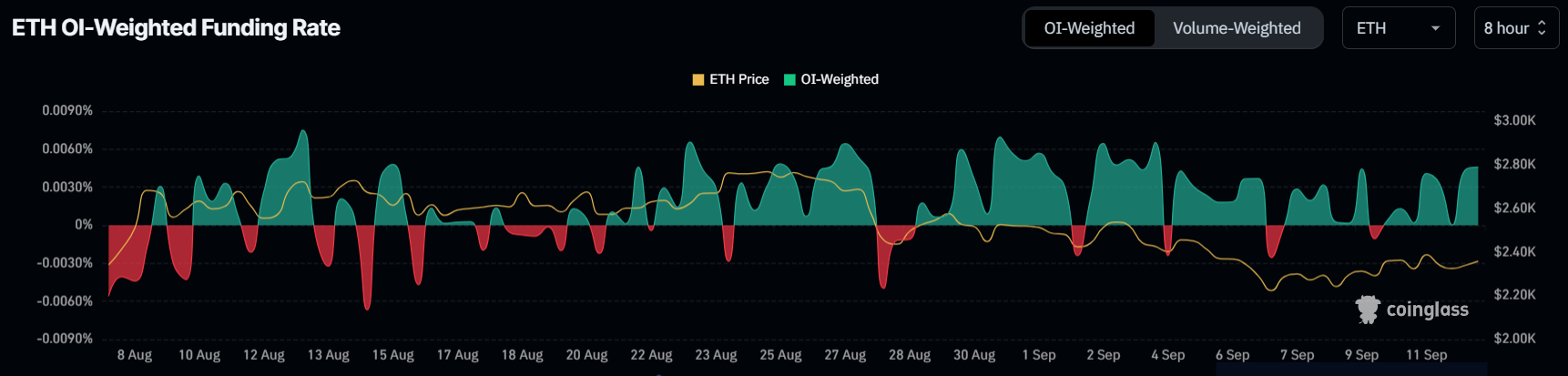

However, despite the macro downtrend, some technical indicators, such as the funding rate, remain positive. On a smaller scale, this suggests that traders and investors maintain a hopeful outlook for ETH’s price trajectory. The positive funding rate reflects that market participants expect the price to recover, even though Ethereum is still locked in a downward pattern.

This optimism is a sign that, while Ethereum is currently struggling to break free from the macro downtrend, underlying momentum could eventually push the cryptocurrency upward. Traders betting on recovery continue to add long positions, indicating that ETH’s recovery may be slow but still plausible.

ETH Price Prediction: Scare Ahead

In the near term, Ethereum’s price is likely to remain rangebound between $2,681 and $2,344. The cryptocurrency is currently recovering from the eight-month low of $2,220, testing $2,344 as support.

This will be crucial for the next stage of price action. If ETH can maintain this level, it will avoid further downsides and possibly jump-start a bullish trend.

At the moment, ETH seems poised to stop testing the downtrend line as support, which could result in sideways price movement. This phase of consolidation would offer Ethereum the breathing room needed for a potential breakout, allowing the altcoin to recover its previous highs above $2,681.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the flip side, should Ethereum fail to hold the $2,344 support, it risks falling to $2,170, a critical level that would re-test the downtrend line. This would invalidate any short-term bullish outlook and confirm a further bearish continuation. Furthermore, this scenario would place significant pressure on ETH and make recovery harder than previously expected.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.