Why did the crypto market suddenly crash, wiping billions in just hours, and what does this mean for Bitcoin and altcoin investors moving forward?

Crypto markets in freefall

In the last two days, the crypto market has hit a speed bump, experiencing a flash crash that has shaved billions off its total value. The global crypto market cap has dipped by nearly 8.7% in the last 24 hours, hitting $3.52 trillion, according to CoinGecko.

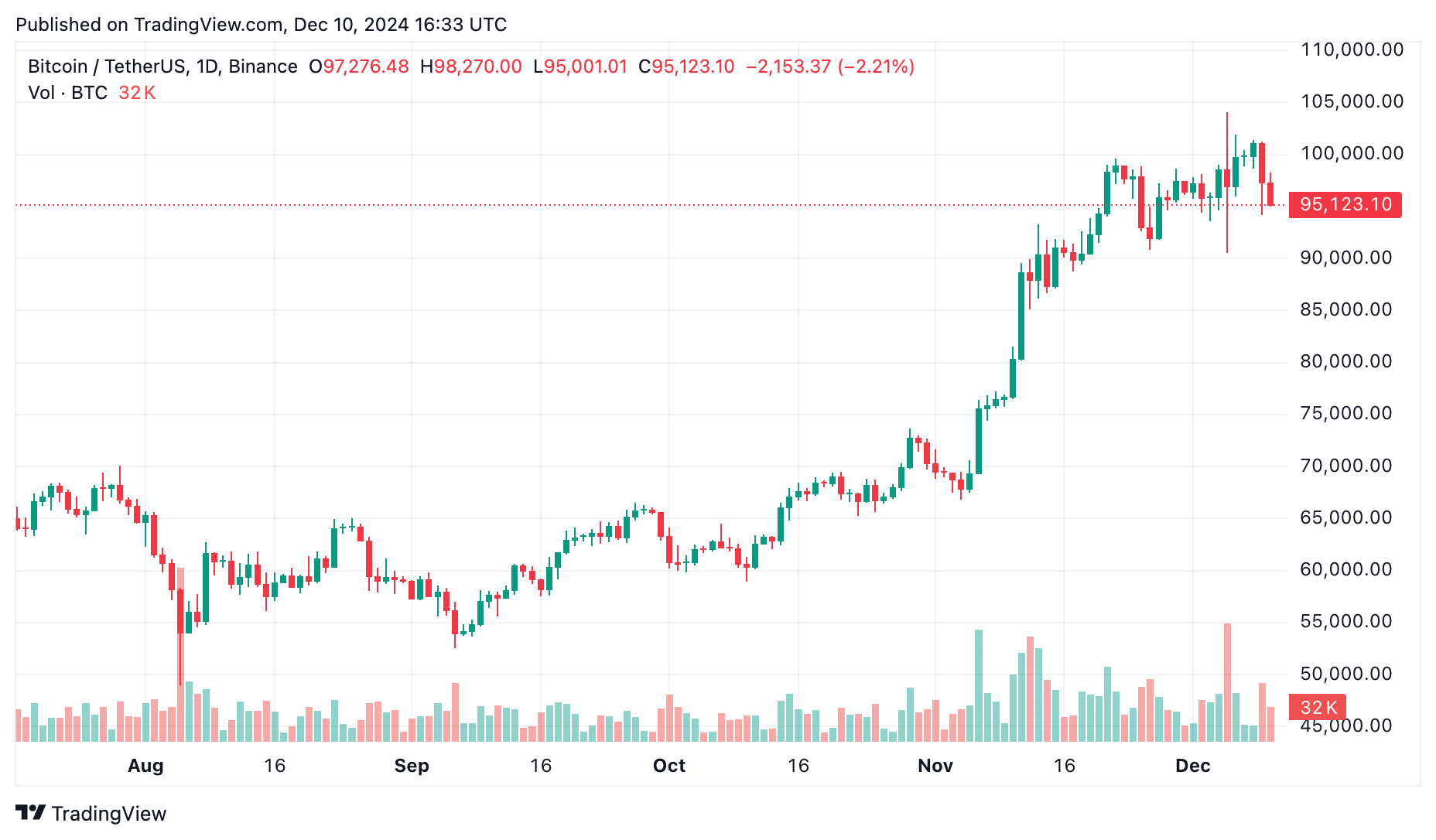

While Bitcoin (BTC) has weathered the storm relatively well, losing a little over 2% to trade at $95,800 as of Dec. 10, the same can’t be said for most altcoins.

Ethereum (ETH) has dropped by around 6%, settling at $3,580 as of this writing, while Ripple (XRP) took a much steeper dive, falling 12.5% to $2.09 and extending its weekly losses to a concerning 17%. Solana (SOL), one of the industry’s top blockchain platforms, has also declined by 6% to trade at $210.

The carnage wasn’t limited to major altcoins. The real bloodbath unfolded in the meme coin segment, with Solana-based meme coins in the Pump.fun ecosystem plummeting by nearly 25%.

Tokens like Peanut the Squirrel (PNUT), Goatseus Maximus (GOAT), and Just a Chill Guy (CHILLGUY) recorded losses ranging from 20% to 25%. Even more established Solana meme coins like Dogwifhat (WIF) and Bonk (BONK) declined by 20% and 18%, trading at $2.74 and $0.00003475, respectively.

Beyond the meme coin mayhem, Bitcoin sidechains and gaming tokens were among the hardest hit. Collectively, these sidechains dropped by 24%, with Stacks (STX) down 16% to $2.07 and Core (CORE) plunging 20% to $1.12.

Gaming tokens, a niche closely tied to the metaverse and blockchain-based play-to-earn economies, also suffered sharp declines. Gala (GALA) lost nearly 21%, trading at $0.04342, while Sandbox (SAND) and Decentraland (MANA) dropped by 19% and 18%, respectively.

The question now is, what caused this sudden market turbulence? And more importantly, where does the market go from here? Let’s examine how technical and fundamental indicators are shaping up for Bitcoin and altcoins.

Unraveling the flash crash: What went wrong?

According to a detailed analysis shared by an algorithmic trader, the events leading to the sudden crash on Dec. 9 unfolded in stages, influenced by a mix of market structure weaknesses, high leverage, and liquidity issues.

The sell-off began with aggressive selling on Coinbase, where traders started offloading assets nearly an hour before the major crash. This persistent selling pressure gradually pushed Bitcoin’s price into a precarious zone, setting the stage for what’s known as a liquidation cascade.

When prices dip below certain thresholds, overleveraged positions — those funded by borrowed capital — are forcibly closed by exchanges. This creates a domino effect as each liquidation exerts further downward pressure, triggering more liquidations in a self-reinforcing cycle.

One of the telltale signs that the market was overheated before the crash was visible in the Funding Fee, which reflects the cost of maintaining long or short positions in perpetual futures contracts.

Elevated funding rates typically indicate a heavily bullish sentiment, with many traders betting on price increases. When the market turned against them, the overleveraged positions unwound rapidly, resulting in liquidations on an unprecedented scale.

To put this into perspective, according to CoinGlass data, over $1.64 billion in futures contracts were liquidated in just 24 hours. Out of this, $1.46 billion were long positions — traders betting on price increases — while only $174 million were shorts.

This imbalance clearly reflects how lopsided the market had become, with the majority of participants caught on the wrong side of the trade.

The situation was exacerbated by poor liquidity conditions, especially in smaller altcoins. Coins like XRP, which have massive market caps comparable to major companies, still suffer from relatively low liquidity.

This means that even a few large sell orders can create outsized impacts on their prices. According to the trader, “something absolutely strange happened” as a series of big sell orders hit XRP, leading to a 5% drop in its price within minutes.

Another crucial aspect of the crash was the role of market makers — entities that provide liquidity by continuously buying and selling assets.

When such a massive sell-off occurs, market makers are forced to hedge their positions, which can amplify price movements across multiple exchanges.

For perpetual swaps (a type of derivative), this hedging process triggers stop losses and additional liquidations, making the impact much sharper in a short time frame.

The bigger picture amid the market chaos

While the flash crash on Dec. 9 momentarily disrupted what has been a remarkable bull run, it’s critical to zoom out and examine the broader picture to understand what’s cooking in the market.

First, the macroeconomic backdrop continues to play an instrumental role. The U.S. dollar has faced consistent depreciation in its purchasing power.

As pointed out by The Kobeissi Letter, both gold and Bitcoin, often touted as hedges against fiat currency debasement, are in “a perpetual bull market when indexed against the U.S. dollar”, reflecting broader acknowledgment of Bitcoin as a store of value.

With inflationary pressures persisting and fiscal policies leaning heavily on debt financing, assets like Bitcoin are effectively pricing in a sustained erosion of dollar strength.

Adding fuel to the crypto narrative is the unprecedented growth of institutional adoption. The spot Bitcoin ETF, trading under the ticker IBIT, has shattered records by surpassing $50 billion in assets under management within just 228 days. For context, the gold ETF (GLD) took more than five years to achieve the same milestone.

This institutional tailwind, combined with a 32% surge in Bitcoin’s price over the past month to reach historic levels of $100,000, has injected an additional $1.4 trillion into the broader crypto market, lending further legitimacy to the strong health of the crypto market.

Meanwhile, the CME FedWatch Tool currently suggests an 86% probability of a 25 basis points (bps) rate cut in the upcoming Federal Reserve meeting on Dec.18, up from 64% just a month ago.

Rate cuts typically reduce the cost of borrowing, making risk assets like crypto more attractive. Furthermore, lower interest rates also weaken the dollar, reinforcing the bullish case for Bitcoin as a hedge against devaluation.

If the Fed indeed proceeds with another rate cut, it could further bolster liquidity in the markets, creating a favourable environment for crypto assets.

However, while Bitcoin demonstrates relative stability, the rest of the market remains fragmented, with pockets of over-leverage and underdeveloped infrastructure still posing risks.

What lies ahead for Bitcoin and altcoins?

As the dust settles from the recent crypto market shake-up, the big question is: what’s next for Bitcoin and altcoins?

Starting with Bitcoin, the current sentiment suggests that the journey to higher highs is far from over. Analysts like Doctor Profit argue that the recent sideways consolidation is merely a pit stop, with Bitcoin’s price likely to break out toward targets between $125,000 and $135,000.

Such bullish predictions are grounded in Bitcoin’s history of cyclical price movements, which often see sharp corrections and consolidations before resuming their upward path. For example, Bitcoin’s 2020 bull run saw multiple corrections of 20%-30% before ultimately peaking.

However, not everyone agrees on the immediate path forward. Crypto analyst Nik hints at the possibility of a multi-week correction if Bitcoin fails to maintain momentum above key levels, such as $104,000. He warns that a rejection below $99,000 could signal a prolonged cooling-off period lasting until the new year.

In this sense, a short-term dip wouldn’t necessarily negate the broader bullish narrative but might provide a healthy breather for the market.

Turning to altcoins, the outlook appears even more intriguing. Michaël van de Poppe suggests that altcoins are on the verge of breaking out of their longest bear market. According to Van de Poppe, with a weakening U.S. dollar and expectations of increased liquidity, the stage seems set for a giant altcoin rally.

Poppe’s optimism is echoed by Kaizen, who drew parallels to December 2020, when a 30% drawdown in altcoins preceded a three-month rally that delivered gains exceeding 400%. The recent 25% drawdown in altcoins, while painful, might similarly act as a precursor to explosive growth.

Still, it’s essential to temper optimism with caution, the crypto market’s inherent volatility means that sentiment can shift overnight, as seen during the recent flash crash. Hence, trade wisely, and never invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.