The crypto market is roaming in a highly volatile zone as long liquidations start to rise. Bitcoin and Ethereum have both entered the overbought zone.

According to data provided by Coinglass, the total crypto liquidations increased by 70% over the past day, reaching $650 million — $366 million longs and $284 million shorts.

Only a few rising tokens, including Bitcoin (BTC), saw heightened short liquidations — the majority of the crypto assets have already been recording long liquidations. This suggests a potential market-wide cooldown as the highly volatile sector is showing signs of overheating.

Bitcoin saw $122.1 million in liquidations —$37.5 million longs and $84.6 million shorts — per Coinglass data. This was majorly due to the flagship asset’s rally to a new all-time high of $81,858 with a $1.6 trillion market cap today.

Ethereum (ETH), on the other hand, registered $91.2 million in liquidations over the past day — $56.7 million longs and $34.5 million shorts, according to Coinglass. The leading altcoin has already started its downward momentum from its three-month high of $3,241.

The majority of the liquidations, worth $262 million, happened on Binance, the largest crypto exchange by trading volume. Of this tally, 59% are long positions.

Data from Coinglass shows that the total crypto open interest gained 1.13% over the past day and is currently sitting at $91.9 billion. The global cryptocurrency market cap also reached a three-year high of $2.9 trillion with a trading volume of over $300 billion.

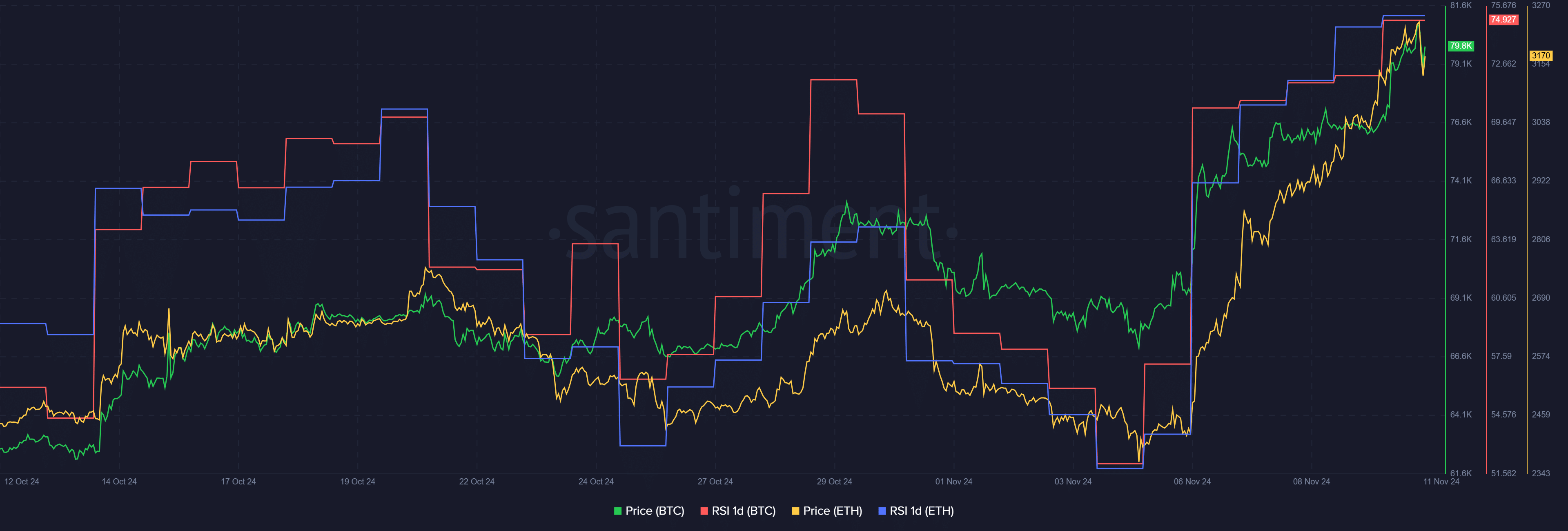

Bitcoin, Ethereum RSIs rising

Bitcoin’s surge above the $80,000 mark put it in the overbought zone as its Relative Strength Index reached 75. This usually happens when a sudden price surge happens, increasing the possibility of short-term profit-taking.

Ethereum witnessed a similar movement as its price surpassed $3,200 — the ETH RSI is currently at 74.

The leading altcoin declined 1% in the past 24 hours and is trading at $3,150 at the reporting time. One major reason would be the start of long liquidations.

High volatility would be expected in the market before another major push due to the increasing open interest, liquidations and trading volume.

Gemini co-founder Cameron Winklevoss believes that the bull run has not been triggered by retail investors. On the other hand, CryptoQuant CEO Ki Young Ju claimed that the futures market has “overheated” and might hint at a bearish 2025 ahead.