Bitcoin’s (BTC) price climbed to $70,000 today ahead of the US presidential election, indicating the connection between major political events and cryptocurrency movements. Historically, political uncertainty and significant elections have influenced crypto market sentiment and volatility.

As the election begins, on-chain analysis provides insights into potential future price movements. Analysts are also weighing in on the implications of the election outcome for Bitcoin, with opinions varying on whether the cryptocurrency could continue its upward trend or face downward pressure. Here are all the details.

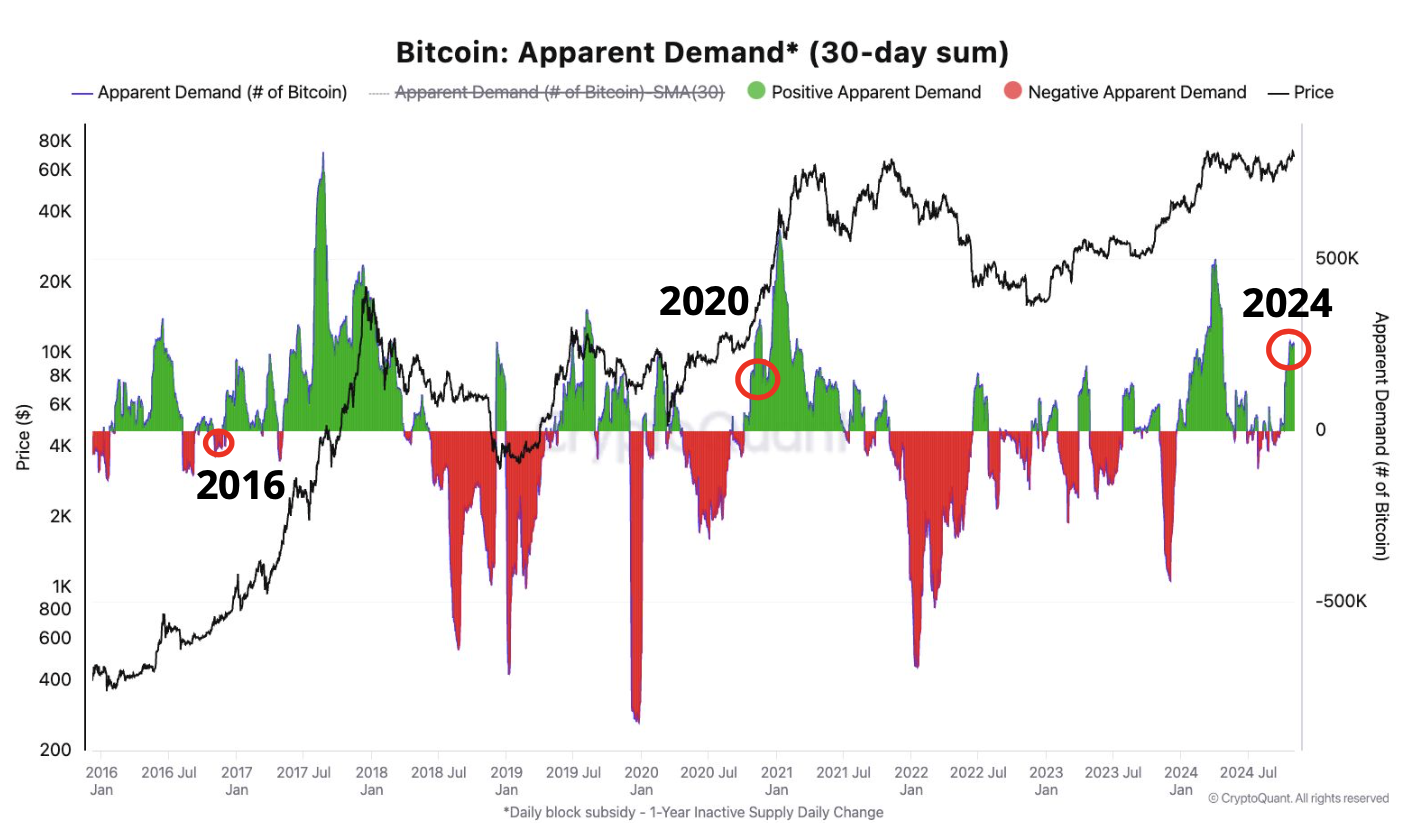

Demand Spike for Bitcoin Echoes 2016 and 2020 Trends

According to Glassnode, the Bitcoin price increase comes amid a drop in the sell-side risk ratio. This metric shows whether investors are confident about a bullish performance or if conviction is low.

High values in this metric indicate periods when significant amounts of value are being realized, often correlating with increased market volatility. Such periods are commonly seen during the late stages of bull markets.

Conversely, low values suggest periods with minimal value realization and reduced market volatility. This can also signal macro market bottoms, accumulation phases, and environments with lower sell-side pressure and risk, potentially indicating the onset of future bullish trends.

Read More: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Therefore, the rise in Bitcoin’s price indicates that selling pressure is low, and the US elections could be bullish for the cryptocurrency.

Regarding this development, Juan Pellicer, Senior Researcher at IntoTheBlock, opined that a Donald Trump win would be good for BTC and the crypto market at large.

“The market appears primed for further upward movement, with the US election serving as a potential catalyst. Sentiment suggests that Trump’s more favorable stance on cryptocurrencies could provide the momentum needed for a decisive breakthrough to a new all-time high.” Pellicer told BeInCrypto

Meanwhile, CryptoQuant’s weekly report says that BTC is at a favorable price level ahead of the elections. It noted that the cryptocurrency is currently not overvalued. Hence, if demand increases, Bitcoin’s price might rally post-election.

For instance, BTC prices rallied by 22% between election day and December 2012. In 2016, it climbed by 37%, while the cryptocurrency saw a 98% increase in 2020.

Therefore, if past performance influences future trends, the BTC might reach a new all-time high before the end of the year.

Data from the on-chain data provider also showed that demand for Bitcoin has increased. This is similar to the trends of 2016 and 2020. Hence, if sustained, the Bitcoin price might climb well above $70,000 soon.

BTC Price Prediction: $73,000 Possible

On the 1-hour chart, Bitcoin has attempted to break out on four different occasions. However, each time that happened since October 31, the coin faced rejection. However, today, the trend has changed as bulls pushed the cryptocurrency above $68,336.

This breakout has ensured that Bitcoin’s price has risen to $70,288. Furthermore, the Bull Bear Power (BBP) shows that bulls are in control. If sustained, Bitcoin’s price might rally much higher in the coming days.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

If bullish momentum persists, Bitcoin could potentially climb to $73,623 ahead of the announcement of the US election results. However, should BTC face rejection at resistance levels, this forecast might be invalidated, with the cryptocurrency possibly declining to $67,405.

The post US Election Day Boosts Bitcoin to $70,000: Further Rally Ahead? appeared first on BeInCrypto.